Mike Robinson doesn’t scare easily.

The president of LaVERDAD Marketing & Media is a former Green Beret who led Special Forces units on operations in Central and South America, going up against dictators and drug kingpins.

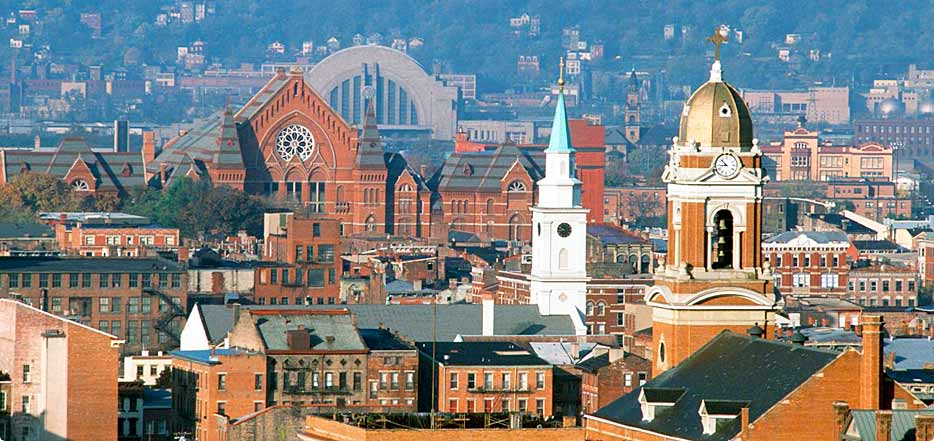

His business experience includes working as a global manager with the Procter & Gamble Co. before launching LaVERDAD in 2003. The company specializes in helping clients reach multicultural consumers. It’s headquartered in Cincinnati and operates throughout the United States.

In 2007, Robinson was named U.S. Hispanic Chamber of Commerce Businessman of the Year. That same year, LaVERDAD was named the National Minority Supplier Diversity Council’s Regional MBE of the Year.

What are some of the most important leadership lessons you’ve learned?

I learned a long time ago to follow a simple rule: lead, follow or get out of the way. A good leader knows when to back off and follow the lead of others. At times, a good leader realizes their most important contribution may be to order takeout food for the team.

How has the current economy impacted the way you lead?

We’ve become very mission-focused. We stay fixated on making Friday’s payroll. We’ve also learned it’s important to lead by example while demonstrating commitment to our mission, our clients, stakeholders and team.

What’s the best way to handle change at work?

Get ahead of it. When I worked for Procter & Gamble I attended a leadership workshop where we studied managing change and organizational improvement. We read the book “Who Moved My Cheese.” You should try to have new cheese in the pipeline rather than waiting for the cheese to run out before reacting. We leverage the same principle for our clients.

What’s your business outlook for 2010?

We expect significant incremental revenue, double-digit profitability and additional job creation.

What advice would you give a new boss?

If you hire people who are smaller than you, you’ll become a company of dwarfs. But if you hire people who are bigger than you, you’ll become a company of giants.

What’s your definition of a miserable, unsatisfying life?

Not making contributions that improve the world around you.

You’ve just been given $100,000 to donate to charity. Which and why?

A new favorite is the Anthony Muñoz Foundation. Anthony is a living Latino legend, and I have really gotten to know him and his team in the past year because of our branding and marketing work for his company, Muñoz Brandz. We share the same credo of working hard to make a difference.

What scares you?

I was a member of an elite (Green Beret Special Forces) unit which conducted operations against the likes of Panamanian dictator Manuel Noriega and the Medellin Cartel. We were taught to overcome our fears. We learned to face danger and to confront opposition with undaunting commitment and decisiveness. Today, what scares and saddens me is disparity. I mean disparity in education, health care-related disparities and also the lack of economic inclusion.